Consumer's Best Verdict: Best Egg Highlights

Best Egg is a well-regarded online lender specializing in personal loans, designed to help individuals manage debt, finance large purchases, or cover unexpected expenses. They emphasize a quick application process and fast funding for qualified borrowers.

For consumers with good to excellent credit seeking a streamlined personal loan experience with competitive rates, Best Egg is a strong contender. While origination fees are a factor, their efficient service and flexible loan options make them a valuable choice for many.

In-Depth Look: Best Egg Features & Considerations

Core Features & Consumer Benefits

Best Egg personal loans are structured with several key features aimed at providing a positive borrowing experience:

Rapid Funding

Approved borrowers can often receive their loan funds in as little as one business day, making it ideal for time-sensitive financial needs.

Competitive APRs for Strong Credit

Individuals with good to excellent credit scores may qualify for attractive interest rates, potentially lowering overall borrowing costs.

Flexible Loan Amounts and Terms

Best Egg offers a range of loan amounts (typically $2,000 to $50,000) and repayment terms (usually 3 to 5 years), catering to diverse financial situations.

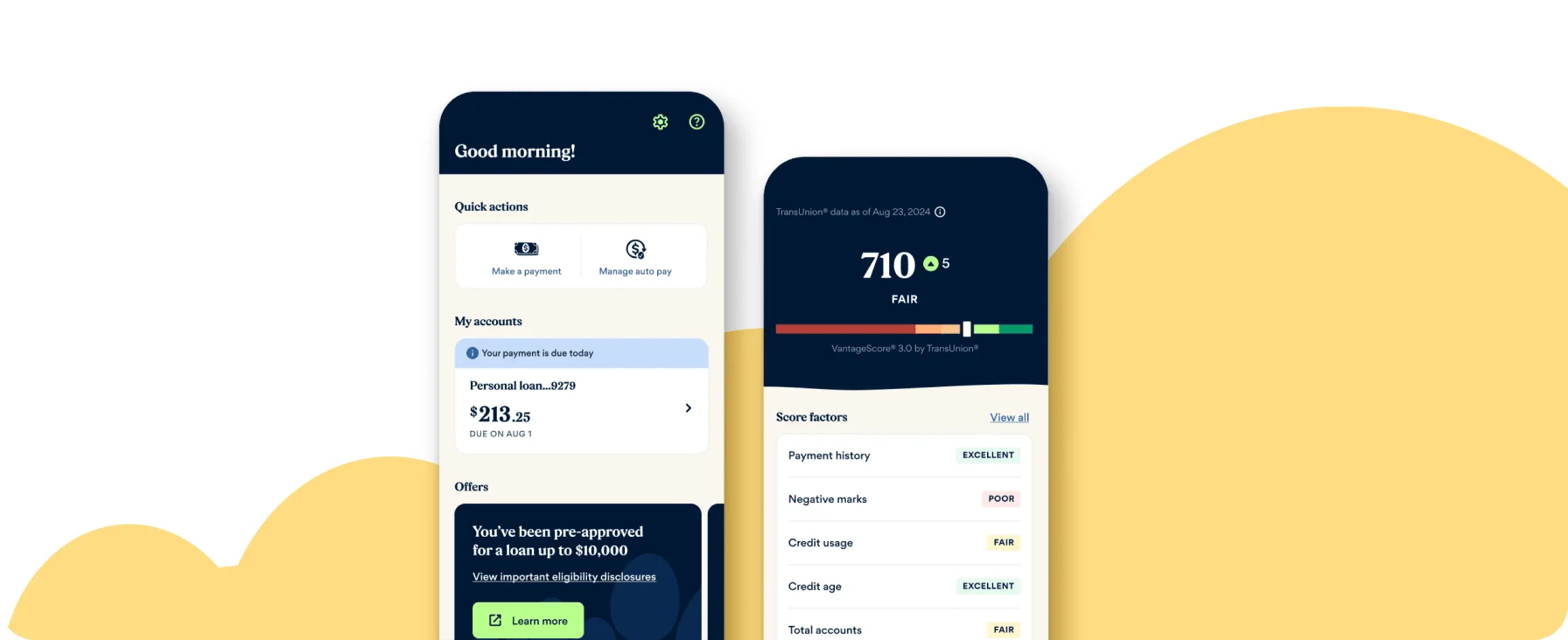

User-Friendly Online Application

The application process is straightforward and entirely online, allowing prospective borrowers to check their potential rates without impacting their credit score initially.

No Prepayment Penalties

Borrowers have the flexibility to pay off their loan early without incurring any additional fees, which can save on interest.

Important Considerations & Potential Downsides

- Origination Fees Apply

Most Best Egg loans come with an origination fee, typically ranging from 0.99% to 8.99% of the loan amount, which is deducted from the loan proceeds.

- Best Rates Require Excellent Credit

To secure the lowest advertised interest rates and most favorable terms, applicants generally need a strong credit history and high credit score.

- Primarily for Personal Use

Loans are intended for personal, family, or household purposes, not for business ventures or post-secondary education expenses.

- Not Available in All States

While Best Egg serves most of the U.S., their loans may not be available in every state or U.S. territory. It's important to check their website for current availability.

Who Is the Best Egg Best For?

Individuals with Good to Excellent Credit

Those with FICO scores generally 640 or higher are more likely to qualify and receive favorable terms.

Debt Consolidation

A common use is to consolidate higher-interest debts (like credit cards) into a single loan with a potentially lower fixed rate.

Borrowers Needing Quick Access to Funds

If speed is a priority, Best Egg's fast funding timeline is a significant advantage.

Financing Home Improvements

Suitable for funding renovations, repairs, or upgrades to your home without needing a home equity loan.

Covering Major One-Time Expenses

Useful for large purchases such as medical bills, car repairs, moving costs, or other significant personal expenditures.

Who Might Want to Explore Other Options?

- Applicants with Fair or Poor Credit

Those with credit scores below Best Egg's typical threshold may struggle to get approved or may face very high rates.

- Individuals Seeking Loans Without Origination Fees

If avoiding an upfront fee is crucial, other lenders offer personal loans without this charge.

- Borrowers Needing Very Small or Very Large Loan Amounts

If your loan requirement is outside Best Egg's standard range (e.g., less than $2,000 or significantly more than $50,000).

- Consumers Preferring In-Person Banking

As an online lender, Best Egg does not offer branch services, which may not suit those who prefer face-to-face interactions.

Frequently Asked Questions

Make Your Savings Grow Faster.

UFB Direct, a division of Axos Bank, offers a high-yield savings account designed for individuals looking to maximize their interest earnings with minimal fees. It's an online-only option focused on providing competitive rates and a straightforward banking experience.